geothermal tax credit canada

Geothermal energy in the United States was first used for electric power production in 1960The Geysers in Sonoma and Lake counties California was developed into what is now the largest geothermal steam electrical plant in the world at 1517 megawattsOther geothermal steam fields are known in the western United States and Alaska. To find out more click below.

There is a 26 federal tax credit for residential geothermal heat pumps and a 10 federal tax credit for commercial geothermal heat pump installations.

. If your vehicle meets specific requirements you could receive a tax credit. In addition to providing the Alaska Public Media program service to Southeast Alaska KTOO-TV. New geothermal projects come as a sigh of relief to many firms across the US.

However both the United States and Australia have. The Dixie Valley toad is found only in Nevada and its entire population lives in. Your receipt shows the amount of your investment and the credit you are entitled to.

Please visit the Database of State Incentives for Renewables Efficiency website DSIRE for the latest state and federal incentives and rebates. Green Energy Equipment Tax Credit The Government of Manitoba currently offers a tax credit for geothermal heat pump systems 75 15 and solar thermal energy systems 10. Atlantic investment tax credit of 10 of the cost of prescribed energy generation and conservation properties.

There is a 10 credit for geothermal microturbines 2 MW and combined heat and power plants 50 MW. Heat pumps EV chargers and these home improvements can net an average 500 in savings EPA expands Energy Star program Last Updated. You can claim this refundable tax credit for shares you acquired from a registered employee share ownership plan ESOP at any time in 2021.

Responsibility for administering the tax incentives is shared between the CRA and Natural Resources Canada NRCan. After years in the making the US. The American Recovery and Reinvestment Act adopted in October 2008 allows.

SW Washington DC 20585 202-586-5000. Geothermal industry is finally gaining momentum. 5 2022 at 1039 am.

This provision has now been extended in respect of commercial disputes where a credit note can now be issued within 30 days after determination of the matter. The maximum tax credit that you can claim on your 2021 return is 27000. Solar electric and water heating.

Find the latest business news on Wall Street jobs and the economy the housing market personal finance and money investments and much more on ABC News. A Dixie Valley toad sits atop grass in Dixie Valley Nev on April 6 2009. The Energy Central Power Industry Network is based on one core idea - power industry professionals helping each other and advancing the industry by sharing and learning from each other.

Your money would be better spent on insulation quality windows and all the stuff mentioned above. The program is known as Energy Star. Geothermal will cut your bills in half for maybe 25-40K so if your heating bill is only 3 or 4 hundred bucks a year then youd need to live longer than Yoda to.

Federal Tax Credit. An uncertain tax treatment is a tax treatment used or planned to be used in an entitys income tax filings for which there is uncertainty over whether the tax treatment will be accepted as being in accordance with tax law. Solar fuel cells 150005 kW and small wind 100 kW are eligible for credit of 30 of the cost of development with no maximum credit limit.

Home Accessibility Tax Credit. However Manchin wants the tax credit for nuclear plants to last for 10 years four years longer than in the draft Bloomberg reported on Thursday citing three sources with knowledge of the matter. An individual who is eligible for the disability tax credit for the year.

Tax Credits Rebates. For tax years beginning after 2021 PL. This investment tax credit varies depending on the type of renewable energy project.

Budget 2021 proposes several personal income tax measures including an expanded list of criteria for determining an individuals eligibility for the disability tax credit an enhancement to the Canada Workers Benefit for low and modest income workers and expanded access to the travel component of the Northern Residents Deductions. How to claim this credit. Get Published - Build a Following.

Learn More About Financing US. KTOO provides a variety of public services throughout Alaska. Facebook Twitter Youtube Instagram Linkedin.

Under Section 30Da the IRS explains you can receive the Plug-In Electric Drive Vehicle Credit if you purchased a car or truck that has at least four wheels weighs less than 14000 pounds and uses energy from a battery with at least 4-kilowatt hours that can be recharged from an external. Geothermally generated electric power can. We also have attractive loan options available in Canada.

The ITC is generated at the time the. That have long been pursuing the. The federal governments plan to introduce a tax credit for carbon capture utilization and storage CCUS technology hit the top tier of the Canadian climate agenda this week after more than 400 climate scientists and other academics wrote to Deputy Prime Minister and Finance Minister Chrystia Freeland urging her to drop the idea.

The purpose of this Chapter is to describe these incentives and the criteria necessary to benefit from them. However beginning in 2012 the program has mostly expired except for credits geared at the production of residential energy. The current provision is that credit notes can only be issued after six months from the invoice date.

Sign Up for Email Updates. Learn more about this program and how. Refund of tax on bad debts.

At present there is no requirement in Canada to disclose uncertain tax treatments. For example a fuel cell with a 5 kW capacity would qualify for 5 x 1000 5000 tax credit. Geothermal heatingcooling We love it as a concept and its great for larger buildings not smaller homes.

There is no upper limit on the amount of the credit for solar wind and geothermal equipment. If you have certain energy-efficient aspects of your home you could receive a tax credit. 115-97 repealed expensing of RE expenditures including software development costs under Section 174 and required such expenditures to be capitalised and amortised over a five-year period beginning with the midpoint of the tax year in which the specified RE expenditures were paid or incurred.

Solar Panel Rebate Program pending Efficiency Manitoba announced in 2019 they will have a permanent solar panel rebate program in place by 2022. The maximum tax credit for fuel cells is 500 for each half-kilowatt of power capacity or 1000 for each kilowatt. In past years as an incentive to conserve energy at home the federal government has offered tax credits to homeowners who purchase energy-efficient appliances.

For people that need to renovate their home to accommodate a person with disability or medical condition you will be offered some tax relief for the project typically up to 10000 per year In order to be eligible you need to be.

Canadian Tax Credits For Energy Efficient Homes

Heat Pump Rebates In Various Canadian Provinces

Put More Money In Your Pocket Create Jobs In America And Help Fight Climate Change By Going Solar The Resident Home Maintenance Energy Efficient Homes Solar

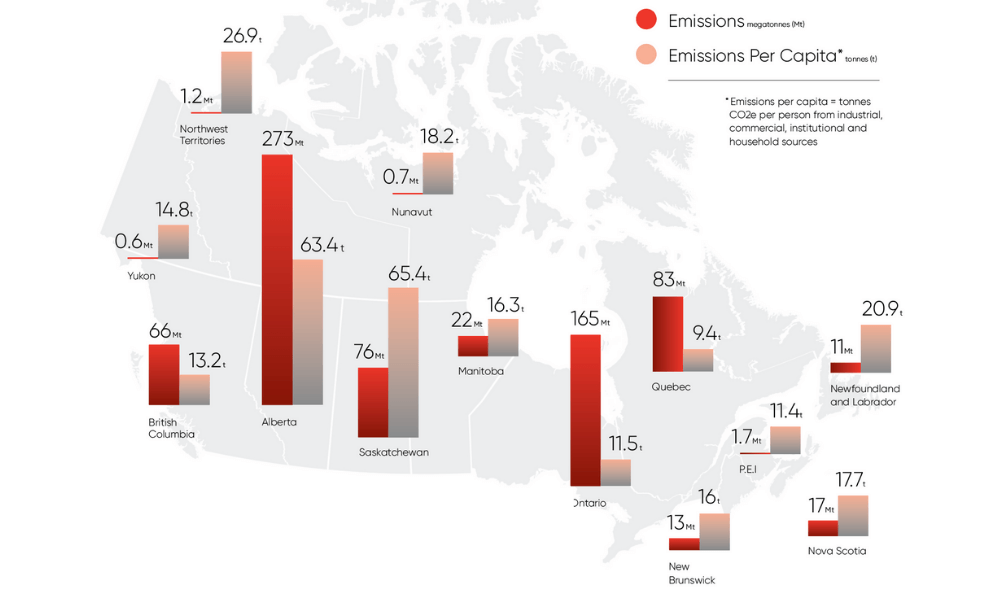

Net Zero Report Card How Future Friendly Are Canadian Provinces Corporate Knights

Canada S 170 Ton Carbon Price Makes Heat Pumps Financial Winners Cleantechnica

Incentives Grants Geosmart Energy

Solar Tax Credits Incentives And Solar Rebates In Canada

Tombstone Territorial Park Yukon Canada Bing Images Travel Pictures Natural Landmarks Travel